See Our Latest Blogs

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer ex dui, pellentesque sit amet mi et

Why Overtrading Is Killing Your Portfolio: 15 Truths Every Trader Must Know

Why Overtrading Is Killing Your Portfolio: 15 Truths Every Trader Must Know

1. What Is Overtrading?

Overtrading happens when a trader executes too many trades within a short period, often without a clear plan, reason, or signal. It's driven more by emotion than strategy and usually results in excessive risk, poor decision-making, and long-term portfolio damage. Some traders overtrade because they feel compelled to "always be in the market." Others do it out of boredom or revenge after a loss. Regardless of the trigger, the outcome is usually the same: account volatility, reduced profitability, and eventual burnout.

2. Common Examples of Overtrading

Entering trades too frequently without waiting for strong setups

Doubling down after a losing position to “average down”

Trading during low-volume or volatile times just to stay active

Opening trades across too many assets to increase action

Taking impulsive trades based on FOMO (fear of missing out).

3. The Psychology Behind Overtrading

Understanding the emotional triggers is the first step to breaking the habit.

3.1-Greed and the Illusion of Control

Greed can fool traders into thinking that more trades equal more profits. But frequent trades often lead to poor setups and random outcomes.

3.2-Revenge Trading After a Loss

Losing money can cause traders to immediately try and win it back. This impulsive behavior often results in bigger losses and regret.

3.4-The Thrill-Seeking Mindset

For some, trading becomes an emotional high. The dopamine hit from entering a trade can become addictive just like gambling.

4. How Overtrading Destroys Your Portfolio

Overtrading isn't just a bad habit. It's a capital killer.

4.1-Higher Transaction Costs

Every trade incurs a cost—spreads, commissions, slippage. Frequent trades multiply these expenses and eat into profits fast.

4.2-Increased Exposure to Losses

The more positions you take, the more chances you give the market to go against you.

4.3-Decision Fatigue and Burnout

Making too many decisions in a day wears down mental clarity. You’re more likely to make emotional or irrational choices.

4.4-Account Volatility and Drawdowns

Overtrading leads to massive equity swings. You may win big one day and lose it all the next. That instability prevents portfolio growth.

5. 15 Ways to Stop Overtrading Immediately

Time to fix the leak in your portfolio.

1. Use a Trading Journal

Track every trade. Include reasons for entry/exit, time, and your emotional state. You’ll start seeing patterns fast.

2. Limit Trades Per Day or Week

Set a cap—e.g., 2 trades per day or 5 per week. If you hit it, walk away.

3. Define Entry and Exit Rules

Never trade just because “it looks good.” Have strict entry/exit criteria and stick to them.

4. Trade Only When Conditions Match

If your strategy works best in trending markets, don’t trade in a range. Wait for your setup.

5. Use a Checklist Before Every Trade

Create a pre-trade checklist. If conditions don’t meet 100%, skip it.

6. Switch to Higher Timeframes

Scalping tempts overtrading. Try 4H or daily charts to reduce temptation.

7. Use Trade Alerts Instead of Constant Watching

Set alerts and only look when conditions are triggered.

8. Turn Off Market Noise

Stop watching influencers or social media traders. Follow your plan.

9. Take Breaks Between Trades

Force a cool-down period of 30–60 minutes after closing a trade.

10. Avoid Trading After a Big Loss

Emotionally charged trades are dangerous. Pause. Reflect. Reset.

11. Focus on Quality, Not Quantity

Would you rather have 2 A+ trades or 10 random ones?

12. Trade with a Mentor or Accountability Partner

Share trades with someone who will challenge your decisions.

13. Use Demo Mode to Detox

Still feeling the urge? Trade fake money for a few days to reset.

14. Automate Your System

Let algorithms enforce discipline if your emotions can't.

15. Celebrate No-Trade Days

Sometimes, the best trade is no trade. Reward yourself for patience.

6. Real-Life Case Studies of Overtrading Gone Wrong

John, a new forex trader, made 87 trades in two weeks. He doubled his account, then lost it all in 48 hours due to overexposure and emotional revenge trades.

Lisa, a swing trader, gave in to FOMO and started scalping. Her profit curve became a roller coaster. After a 40% drawdown, she returned to her system—and her profits came back.

7. Overtrading vs. Active Trading: Know the Difference

Not all high-frequency trading is overtrading. Professional traders take many trades, but every trade is planned, sized, and executed with discipline.Overtrading = impulsive

Active trading = intentional

8. Tools to Prevent Overtrading

MetaTrader/CTrader trade limits

TradingView alerts and checklist widgets

Edgewonk or Myfxbook for journalingRisk calculators and trade validators

9. Trade Less, Profit More

Overtrading is the silent killer of trading accounts. It drains your capital, erodes your mental clarity, and turns a strategic endeavor into a gambling game. But the good news is, it's 100% fixable.

Prioritize quality, stick to your strategy.

Sometimes the smartest trade is no trade at all!

When you trade less but with intention, your portfolio rewards you.

Driving Growth, Amplifying Impact

George Owens

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

Kim Wexler

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

James Cart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

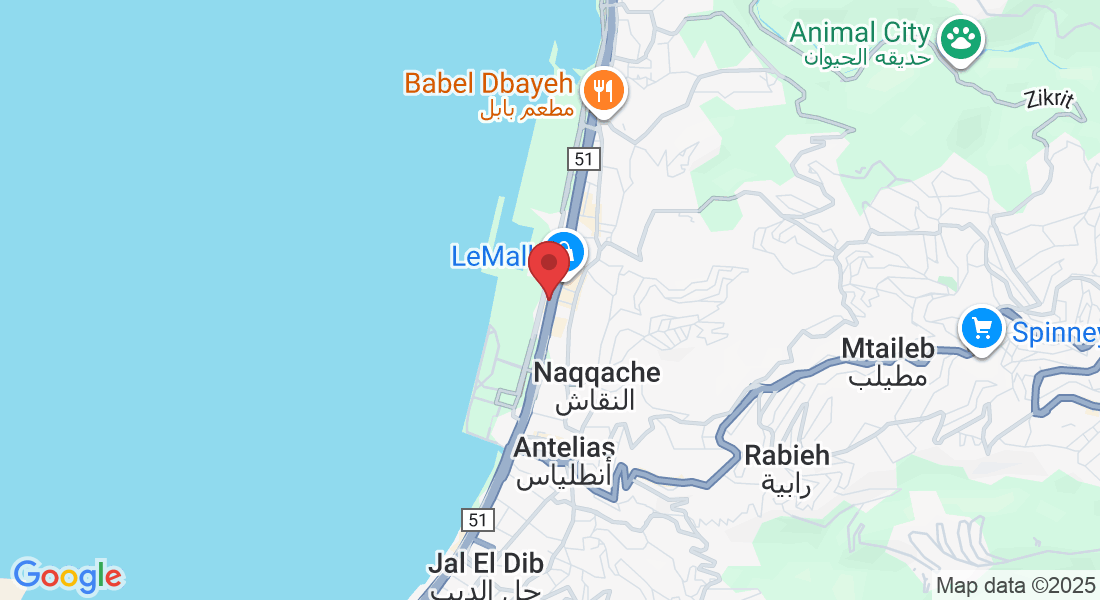

Get In Touch

Email: [email protected]

Address

Office: Dbayeh - water front street - Home Station Building - 3d floor

Assistance Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Phone Number:

+96181103586

YOU BECOME WHAT YOU BELIEVE, SO BELIEVE IN YOURSELF

Join the Bull & Bear Movement Now

© 2025 Stephanie Awad. All Rights Reserved.

Unauthorized use, reproduction, or distribution of this content is strictly prohibited.